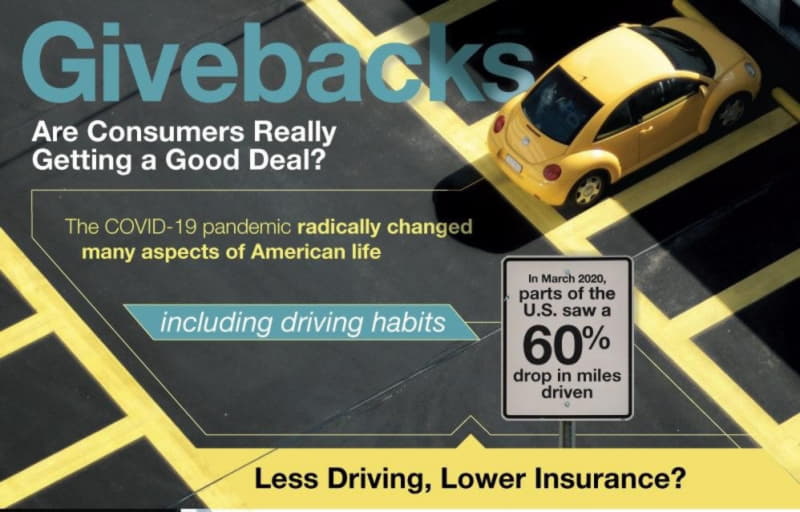

Allstate, Geico, Progressive, and State Farm gave billions back to their policyholders as a response to the COVID-19 pandemic this past Spring. American driving habits were radically altered when COVID-19 forced many people to stay home as cities went on lockdowns and jobs were moved remotely. Less driving meant that insurance companies were saving millions of dollars as insurance claims decreased greatly. Parts of the U.S even saw a 60% drop in miles being driven and that meant less low-speed accidents and fewer incidents of aggressive acceleration. Many insurance companies saw this as an opportunity to give back money to their drivers in order to help those who were being faced with hardships.

Insurance companies not only provided financial assistance and payment programs that allowed flexibility on paying their bills but they also gave penalty-free grace periods on late payments, paused cancellations due to non-payments, and waived deductibles for commuting healthcare workers. Auto insurance premiums were able to be decreased by up to 25% in the spring and insurance companies returned $14 billion to their policyholders. But was it enough?

There has been a push for a total refund but even a decrease in driving mileage isn’t able to translate to an equal refund in percentage. There are too many variables at play for this to happen. For example, there is a variation in the severity of an accident and unpredictable changes to driving habits, as seen by COVID-19. City lockdowns have also made way for more repair delays and there has been an increased cost for repairs because of supply chain disruptions. On top of this, sometimes less driving actually results in higher insurance claims. With less traffic, there are often more speeding incidents which lead to an increase in claims, and more severe accidents resulting in higher claims.

From a business side insurance companies have to look at a bunch of angles to assess how much a person will cost them. Actuaries determine this by calculating how much risk a person will pose them and then they charge enough so that they can also profit. It’s helpful to understand risk pools here. Since car insurance is required for drivers nationwide there is a wide range of levels of risk between drivers. Those who are high-risk will have a history of violations and those who are low-risk tend to be experienced drivers with no record. Risk pools spread claim cost across more individuals and this helps keep premiums lower. One person’s claims may end up costing more than their premium cost but other driver’s premiums make up the difference so that the company doesn’t lose out on money. Higher-risk drivers are determined to be more costly to the insurance company so their premiums are higher.

A new factor could alter auto insurance for the future and that is the introduction of autonomous driving. With 94% of all car accidents being a result of human error the rise of autonomous driving would eliminate the human error factor which could decrease car accidents. This then in essence would lower auto insurance premiums. One prediction is that by the year 2035 auto insurance premiums could see a reduction of $24 billion. A total refund may not be in the future but lower insurance rates by using an autonomous car could.